The independent optical industry is approaching a breaking point. Not because people no longer need glasses demand has never been higher but because the business model that sustained independents for decades is structurally obsolete.

A recent article exposing why nearly 60% of independent optical retailers risk insolvency sparked an unusually strong response. Its traction revealed something uncomfortable: the market is facing extreme pressure that most industry stakeholders prefer not to acknowledge publicly. This article expands that analysis with verified data, global context, and a hard conclusion: the independent middle of the optical market is gone. What remains is a polarized future: luxury, technology, conglomerates and chains — or disappearance.

The Data No One Wants to Talk About

According to healthcare restructuring advisory firm Gibbins Advisors, the United States recorded:

- 79 healthcare bankruptcy filings in 2023

- 57 filings in 2024

- An average of 42 filings per year between 2019–2022

These are not single-location failures. Many involve independent clinic chains with multimillion-dollar asset bases, not marginal operators.

The data was cited in a 2024 analysis published by The Street, confirming that this is a systemic collapse, not a temporary correction. This matters because if asset-heavy healthcare chains cannot survive, the traditional independent optical model is fundamentally broken.

Demand Is Rising — Independent Retail Is Not

The paradox is striking.

- Screen usage continues to damage eyesight at record rates

- Populations are aging rapidly in Japan, Europe, and North America

- Vision correction is no longer optional, it is inevitable

Yet independent optical retail is shrinking year over year. Why?

Because growth in demand does not automatically translate into growth for undifferentiated retailers.

According to Market Data Forecast, the **European eyewear market is projected to grow from approximately USD 42.43 billion in 2024 to USD 80.72 billion by 2033, representing sustained expansion driven by rising awareness of eye health, fashion trends, and increasing screen usage.

However, what this doubling in market size will actually mean for independent optical retailers remains highly uncertain, particularly when competing against conglomerate-owned stores and large retail chains that dominate distribution and brand visibility.

The challenge for independents is not simply market growth, but how much of that growth can realistically be captured when scale and marketing reach are increasingly skewed toward larger players

The Middle Market Has Already Been Taken

The historic “middle” of optical retail affordable, independent, service-driven has been captured by venture-backed brands such as Ace & Tate and Cubitts.

These companies operate with:

- Strong venture capital backing

- Unified brand narratives

- Seamless online–offline experiences

- Willingness to sell at or near zero margin

They do not need profitability at store level. Independents do.

At the same time, conglomerates like Sunglass Hut under EssilorLuxottica dominate global brand distribution.

Meanwhile, next-generation fashion eyewear brands Gentle Monster, CHIMI, build direct-to-consumer retail ecosystems defined by aesthetics, cultural relevance, and aggressive marketing. There is no room left in between.

When Even the Giants Begin to Shake

Project Lobster has now formally completed its bankruptcy filing, confirming the financial difficulties that had been circulating within the industry. The move marks a significant moment for the contemporary optical retail segment, highlighting the increasing pressure faced even by digitally native, investor-backed brands in the current market environment.

Even well-established retail chains are now showing signs of significant stress, signaling that the challenges in the market extend far beyond isolated corporate failures. Major players in the retail sector are facing store closures, workforce reductions, and strategic retrenchments as competitive pressures and shifting consumer behaviours reshape the landscape. These developments underscore an environment in which even long-standing, capital-rich chains cannot rely solely on scale to guarantee stability, reflecting broader structural weaknesses affecting the industry.

This trend is emblematic of a deeper recalibration within the retail economy, where traditional business models are being tested by evolving cost structures, changing spending patterns, and tighter margins. The ripple effects of these stresses suggest that the sector’s challenges are systemic rather than anecdotal a reality that demands strategic adaptation and renewed focus on resilience if major chains are to navigate the current downturn successfully.

Why the Affordable Independent Segment Has No Future

A frequent question is why the low-end independent segment is not addressed as a growth opportunity.

The answer is uncomfortable but clear: If affordable eyewear is not sold through owned retail and vertically integrated platforms, it has no long-term future.

Even visually strong brands like Gigi Studios and Kaleos are exceptions, not because of product, but because they have:

- Capital

- Investors

- Creative infrastructure

- Long-term brand strategy

Most affordable brands dependent solely on wholesale agents will disappear along with the stores that sell them.

Luxury Is Not the Threat. Technology Is.

Luxury eyewear will survive, just as independent luxury watchmaking has survived alongside smartwatches. It serves an elitist, educated audience insulated from price wars. The real threat comes from AI and Big Tech.

If consumers spend $1,000 annually on smartphones, then $600–$900 on premium eyewear is not expensive, it is under-communicated. This gap exists because of lack of education, not lack of demand.

Companies like Apple, Google, and Meta are redefining wearables. At the same time, teams from Dita and Akoni are being recruited by startups such as Sesame, which was reportedly financed by Sequoia Capital with $200 million in November 2025 to develop smart glasses.

Similarly, members of the marketing team behind Lindberg, following the brand’s acquisition by Kering, were subsequently taken on by Even Realities.

Notably, Gentle Monster has already partnered with Google to develop smart glasses a clear signal that fashion-led, capital-backed brands are structurally positioned for the next wave.

The Price War Is a Guaranteed Loss

If your product is identical to what’s available online on multibrand platforms or down the street, customers will say: “Thanks for the exam — may I have my prescription?”

That puts you into a bidding war with Costco, LensCrafters, Warby Parker, Walmart, and Zenni. You cannot win. A fundamental business truth applies: You can compete on price, quality, or service. Independent optical retail cannot survive on price.

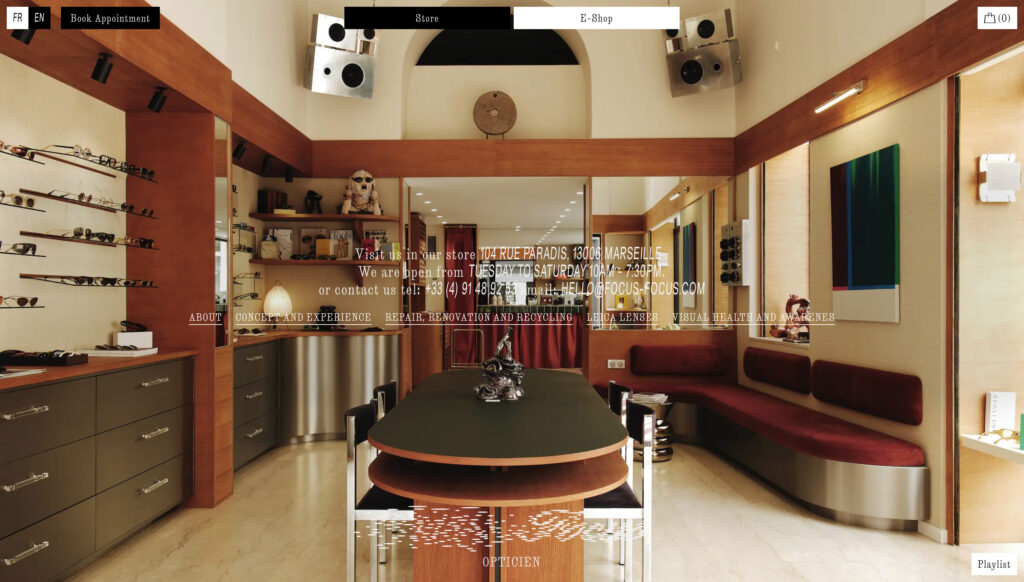

Experience Is the Real Product

Retail experience is not only decoration.

It is:

- Staff behavior

- First impressions

- Human engagement

Luxury brands understand this. At Gentle Monster, staff uniforms dissolve into the architecture, black trousers, black T-shirts, ensuring the space and product dominate. The employee serves the brand, not the ego.

Digital Neglect Is Accelerating Failure

Almost every clinic at risk shares the same flaw: terrible digital presence.

If your website does not visually compete with Ace & Tate, Cubitts, you are already losing. Young customers verify credibility on Instagram and websites before visiting.

Compounding this, independents rely on expensive, outdated software while enterprise players deploy advanced analytics from firms like Palantir and Oracle.

Digital transformation in optical retail remains cosmetic, when it must be strategic.

The Netherlands: A Warning Signal

In 2024, the Netherlands — one of Europe’s most competitive optical markets recorded over 30% more bankruptcies than in 2023, according to Chamber of Commerce data.

Retail bankruptcies reached 61 businesses in 2023, with similar momentum into 2024 and 2025.

Yet Dutch independents are responding by:

- Rejecting low-end competition

- Educating consumers

- Investing in staff excellence and premium positioning

Design alone is no longer enough. People sell luxury.

The Industry Is Not Dead — It Is Polarizing

Over the next 20 years, eyewear will mirror the split between luxury watches and smartwatches.

Those who survive will:

- Educate customers

- Embrace luxury and technology — not the middle

- Treat eyewear as cultural and emotional, not functional

Instinct is no longer sufficient. Know who your customers are. Know their age. Know their values. And explain clearly why a premium pair of glasses should be valued like a premium smartphone. Adaptation is no longer optional.

Why Is Optical Retail Resisting Change — and Why Isn’t It the Opticians?

Today, brands do not need traditional sales agents they need ambassadors. Partners who can communicate vision, aesthetics, and long-term value, not simply move inventory. Direct collaboration between brands and optical retailers would lower friction, open the market to new entrants, and create real competition based on quality, storytelling, and relevance.

As the narrative shifts, so too must the structure. Those who adapt will remain part of the ecosystem. Those who rely on controlling access rather than creating value will inevitably be left behind.

An Industry Resisting Change — as Change Moves In

The optical industry may appear resistant to transformation, but the shift is already underway. The reactions to our recent articles reveal a striking pattern: the strongest opposition does not come from opticians themselves, but from sales agents. Their resistance is not ideological it is structural. They are losing control of the narrative that once sustained their role.

That narrative, however, is no longer shaped by intermediaries. It is increasingly being rewritten by technology companies, data, and vertically integrated brands with direct access to the consumer. In this new landscape, relevance will depend on clarity of positioning, not legacy relationships.

Without a clearly defined niche particularly at the high end independent optical retail will not disappear entirely, but it will be reduced to a far smaller, more fragmented ecosystem. Scale will belong to those who control technology and storytelling; survival will belong to those who understand that differentiation is no longer optional.

Sources & References

- Gibbins Advisors – Healthcare Restructuring Data (2019–2024)

- TheStreet – “Healthcare Provider Chain Files Chapter 11 Bankruptcy”

- Netherlands Chamber of Commerce (KvK) – Retail Bankruptcy Statistics 2023–2024

- Company disclosures and investor reports: Marcolin, EssilorLuxottica

- Industry analysis on wearable technology adoption – Apple, Google, Meta public filings

- Expansion – Catalunya, 5 January 2026, Retail sector pressures and instability among major chains